Capital flight skyrocketed after Russia’s seizure of Crimea from Ukraine in March last year and subsequent support for separatists fighting in eastern Ukraine.

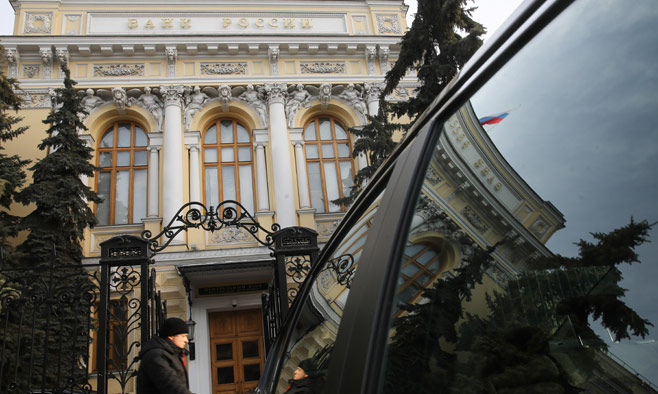

Russia has recorded its first quarterly net capital inflow in five years, with $5.3 billion flowing into the country from July to September, according to preliminary Central Bank data published Friday.

The inflow reverses a period of record capital flight following last year’s sharp fall in the price of oil — Russia’s most important export — and financial sanctions imposed over the Ukraine crisis.

But while the third quarter figure suggests financial conditions have stabilized, $45 billion has still left the country during the first nine months of the year, the Central Bank data showed, compared with an outflow of $76.8 billion in the same period last year.

Outflows are also expected to resume in the fourth quarter, with Economic Development Minister Alexei Ulyukayev predicting Friday that full-year capital flight would be $87 billion, according to the TASS news agency.

Capital flight skyrocketed after Russia’s seizure of Crimea from Ukraine in March last year and subsequent support for separatists fighting in eastern Ukraine. Western sanctions imposed over the conflict limited the access of Russian companies and banks to international capital markets, leaving them with foreign loans worth tens of billions of dollars that they had to repay.

A sharp devaluation of the ruble also prompted companies and individuals to buy and hold foreign currency, while the risk of increased sanctions and Russia’s worsening economy discouraged investors.

But these processes seem to be unwinding. In a statement on Friday, the Central Bank said a reduction in stashes of foreign assets had helped achieve the third quarter inflow.

“Foreign debt repayments were almost completely financed by banks and companies using foreign-currency assets they had accumulated,” Oleg Kuzmin, an economist at Renaissance Capital, told Reuters. “That allowed for a significant improvement in indicators on the financial account.”

The third quarter also saw overseas lenders grant more loans to Russian companies, with firms such as Eurochem and Metalloinvest agreeing deals worth $750 million each with groups of international banks.

The inflow may also reflect growing stability in eastern Ukraine, where violence has cooled in recent months.

Russia last saw a capital inflow — of $4.1 billion — in the second quarter of 2010. Since then, according to Central Bank statistics, almost $416 billion has flooded out of the economy — almost as much as the entire annual economic output of Austria.