With Reserve Bank of India (RBI) Governor Raghuram Rajan deciding not to seek a second term, the government is in the process of finalising Mr Rajan’s successor, and an announcement is expected shortly.

While the names of several economists and bureaucrats are doing roundsone thing certain is that the new governor will face number of challenges ranging from reining in inflation to managing currency volatility. Here is a list of the top challenges.

FCNR (B) Redemption

One of the immediate challenge is the redemption pressure of the Foreign Currency Non-Resident (bank) deposits, or the FCNR(B) deposits, as outflows will start from September. These deposits were raised in 2013 when the rupee was depreciating sharply and went on to hit its lowest against the dollar in August 2013. While Mr. Rajan said the outflows, estimated at about $20 billion, was a non-event, there are concerns of foreign inflows slowing down.

“The redemption of the FCNR(B) deposits can pose a challenge if foreign exchange flows dry up due to Brexit as banks will struggle to deliver more than $10 billion of forwards to the RBI after maintaining nostro balances of $10 billion to $15 billion,” said Indranil Sengupta, Economist and co-head of India Research, Bank of America Merrill Lynch.

Monetary Policy Committee

The new governor will be also the first one to make his policy stance under the new framework of the Monetary Policy Committee. The Centre has already laid down the rules for the selection of its nominees to the panel.

MPC is a departure from the present practice where the entire onus rests on the governor for any rate decision. While the governor will have the casting vote if there is a tie, the responsibility will be shared by the committee. The governor has to ensure that he does not opt for the casting vote frequently. .

Radhika Rao, economist with DBS Bank said the new governor might be tasked with the transition to the new policy framework, in case the panel formulation does not happen before the policy review scheduled for August. After August, the next policy review is on 4 October — after Mr. Rajan’s term expires in early September.

“The approach (of the MPC) will be supportive to the governor. Whatever the decision is, more discussion and better discipline will be ensured with this committee approach which will improve credibility of decision-making,” said Rupa Rege Nitsure, group chief economist, L&T Finance Holdings who was a member of the Urjit Patel committee which mooted the idea of MPC.

Managing expectation

The new governor will take charge amid expectation of sharp cuts in interest rates – something which Mr. Rajan resisted. RBI had reduced the policy rate by 150 bps to 6.5 per cent between January 2015 and now. However, the expectation was that of deeper cuts. The burden of expectation now will fall on the new governor at a time when retail inflation accelerated to a near two-year high of 5.76 per cent in May, driven by surging prices of food products such as pulses and sugar. This is higher than the 5 per cent March inflation target set by the RBI.

Recently released meeting minutes of the technical advisory committee of monetary policy showed that members had expressed concern on the inflation outlook since food inflation rose by 100 basis points, headline inflation moved up by 60 basis points, and after excluding food, fuel, petrol and diesel, inflation edged up marginally and remained sticky in April.

The outgoing governor has cautioned against dropping the guard against inflation. The new governor may find it challenging to manage rate cut expectation of the government and the industry at a time when inflation is on the rise, said a former central banker.

Bank clean up

The new governor also has to complete the task of cleaning up of Indian banks that was started by Mr. Rajan, who had set a deadline of March 2017 to complete the exercise. This will mean banks have to make higher provisions for all the loans that the Asset Quality Review of the central bank found to be either stressed or weak.

There are requests from banks to extend regulatory forbearance that Mr. Rajan has resisted. These requests will resurface again with the new governor taking charge. Also, saddled with bad loans, banks, particularly public sector ones, have squeezed lending. It will be a challenge to kick-start lending in the economy for growth to revive, said a chief executive of a large public sector bank.

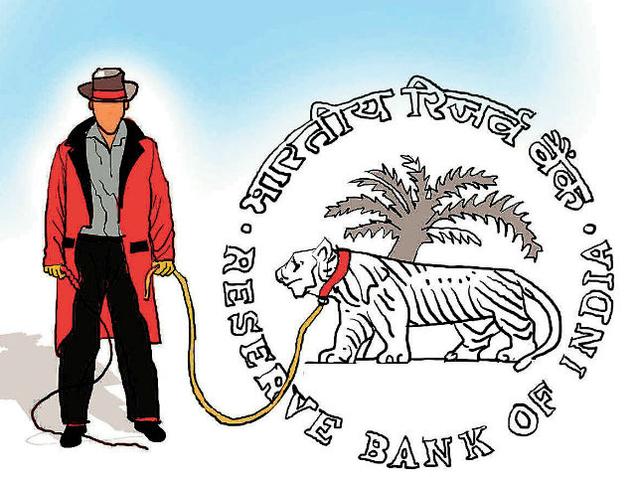

RBI autonomy

Former RBI governor Dubburi Subbarao once famously said that the public perception of autonomy of the central bank is more important than the actual autonomy. Mr. Subbarao, who was the first governor to be appointed straight from the government ranks (where he was the finance secretary), had raised eyebrows among commentators who were sceptical about central bank independence after he took charge.

The same could happen with the new governor irrespective of whether the person comes from government or academia given the public discourse at this point in time with regard to Mr. Rajan’s sudden announcement, two and a half months ahead of the end of his term. Central bank watchers said perhaps the biggest challenge of the new governor will be the constant comparison with the profile of Mr. Rajan who is regarded as a credible policymaker, not only within India but also in international circles.