Bet on India’s growth stories and shun Brazilian behemoths when the Federal Reserve raises interest rates, emerging-market stock-pickers say.

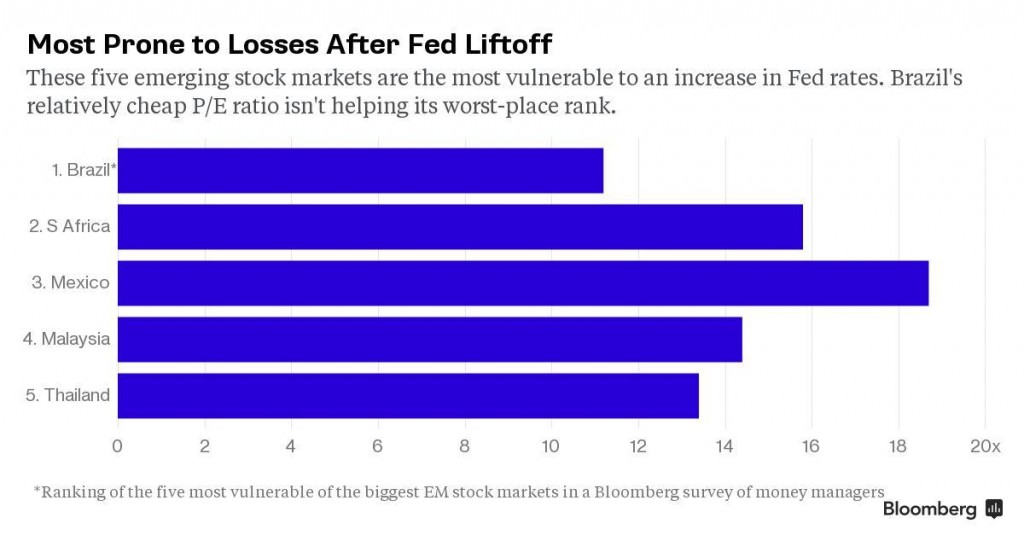

India will probably do best among the 10 largest emerging equity markets after the Fed boosts rates for the first time in nine years, and Brazil the worst, according to a Bloomberg survey of 10 stock fund managers in the U.S., Europe and Asia.

A Fed increase, which may come next month, would herald the end to an era of record-low U.S. interest rates that supported demand for riskier assets. Higher U.S. borrowing costs threaten to lure money out of developing nations, making it costlier to finance budget and current-account deficits.

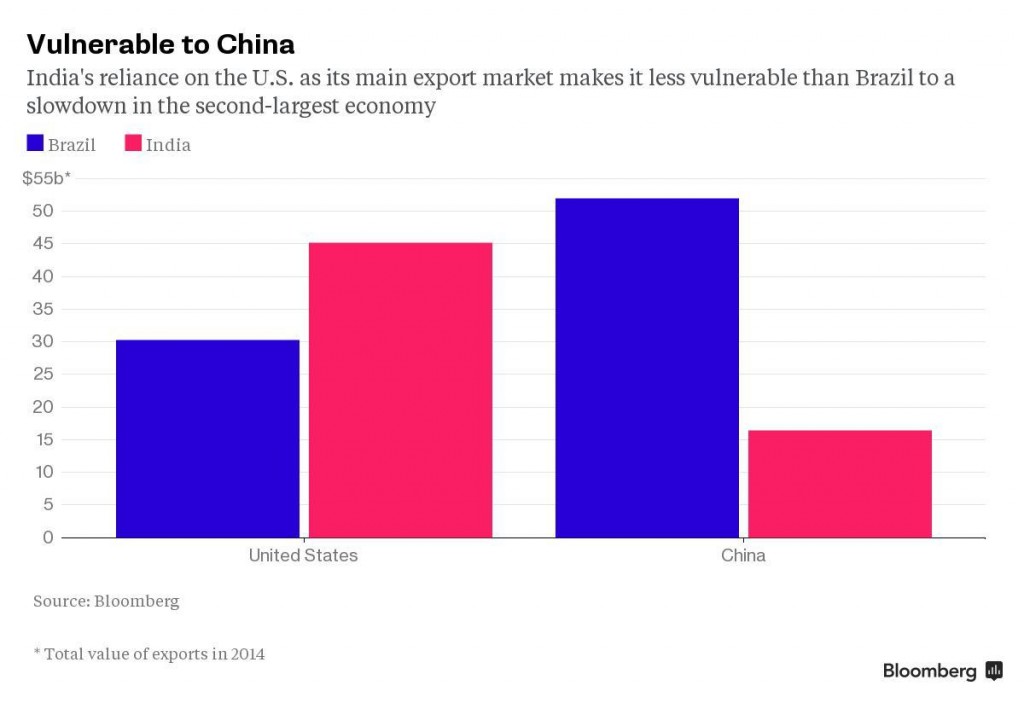

India is less vulnerable to the rising cost of dollar financing and the slowdown in China, two “headwinds” for emerging economies, said Griffiths. A large portion of India’s current-account gap is funded by remittances from abroad rather than investment flows, while the U.S., not China, is its biggest export market, he said.

The landscape is bleaker for commodities-rich Brazil, which relies on Chinese demand for metals and is heading for the worst recession since 1990. President Dilma Rousseff is facing calls for impeachment as her popularity dwindles.

The Bloomberg survey was taken before China roiled global markets by devaluing the yuan, raising speculation other emerging nations will take steps to weaken their currencies to stay competitive.

Investors are encouraged by Indian Prime Minister Narendra Modi’s pledge to crack down on corruption and bureaucracy, push through changes to tax policy and improve infrastructure, according to Julian Mayo, co-chief investment officer at Charlemagne Capital in London. That agenda hit a roadblock yesterday, when the parliament session ended without passing key reforms.

“What Modi is trying to do is to create a more competitive economy, a more commercial economy, encouraging companies to grow and to succeed,” said Mayo, who helps oversee about $2.3 billion in stocks of developing nations and participated in the Bloomberg survey.

The economy in India will probably grow 7.5 percent this year, topping last year’s 7.3 percent, according to the International Monetary Fund. Among Indian companies, both Mayo and Griffiths like Housing Development Finance Corp., the biggest mortgage lender.

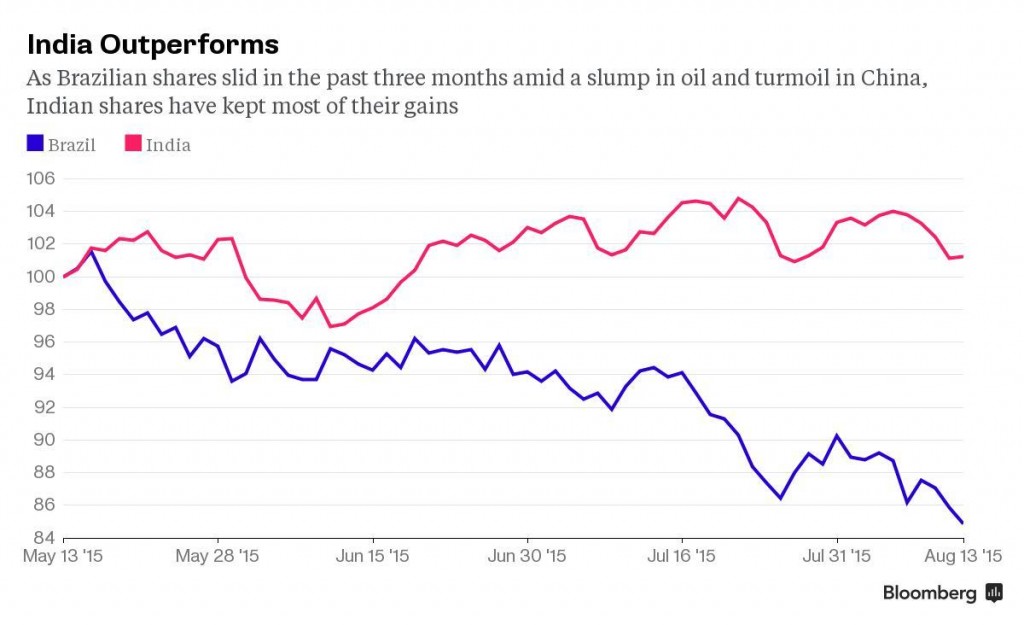

While India, a net importer of crude, stands to benefit from oil’s tumble since May, the situation is the reverse for Brazil. State-run oil giant Petrobras Brasileiro SA, mired in bribery allegations, plunged 33 percent since May 5, dragging Brazil’s benchmark Ibovespa index to an 18 percent decline.

Some Brazilian companies are worth holding despite “the discouraging macro environment,” said Mayo. For one, BRF SA, the nation’s biggest foodmaker, stands to benefit from the real’s slump as its exports become more competitive and overseas revenue grows when converted back to the local currency, he said.

After Brazil, South Africa was the least-favored nation in the survey. The commodity-exporter has a current-account deficit amounting to almost 5 percent of gross domestic product.

In India, “it’s not the traditional names that will do well,” said Mike Sell, a fund manager at Alquity Investment Management in London, which oversees about $98 million. “It’s about stocks that play the urban theme. That’s logistics, education. It’s banking, it’s transportation, leisure.”

Voltas Ltd., an air-conditioning company, Tree House Education and Accessories, a schools operator, and Gateway Distriparks Ltd., a logistics company, are among Sell’s top picks in Mumbai.

Indian stocks rose 12 percent since Modi took office in May 2014, and are trading at 15.5 times 12-months estimated earnings, above a multiple of 11.3 for Brazil. Mumbai-traded shares have outperformed the MSCI Emerging Markets Index, which lost 17 percent in the period and is valued at a multiple of 11.

“Modi’s government is very much focused on the right things, reforming the engine,” Griffiths said. “In the medium term, we’re optimistic.